Estate Planning Attorney Fundamentals Explained

Estate Planning Attorney Fundamentals Explained

Blog Article

4 Easy Facts About Estate Planning Attorney Shown

Table of ContentsEstate Planning Attorney Things To Know Before You BuyEstate Planning Attorney for BeginnersAll about Estate Planning AttorneySome Ideas on Estate Planning Attorney You Should Know

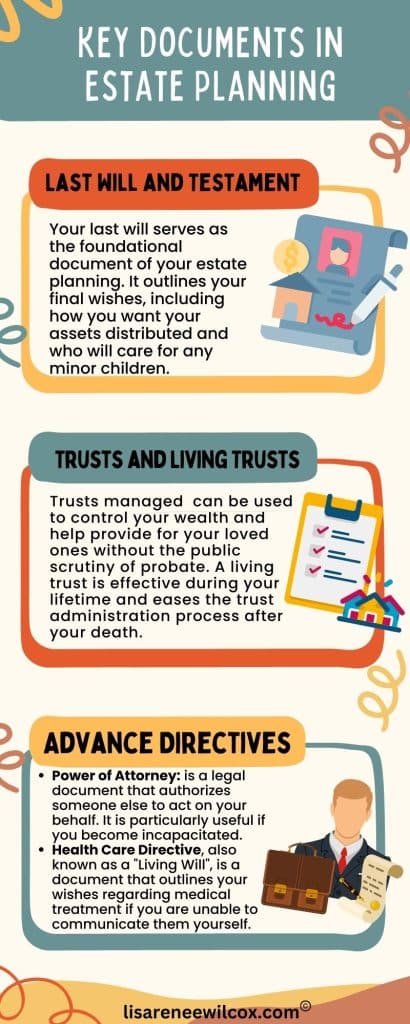

Estate preparation is an activity strategy you can use to identify what happens to your possessions and responsibilities while you're active and after you pass away. A will, on the various other hand, is a lawful paper that lays out just how properties are dispersed, that looks after kids and pet dogs, and any kind of various other desires after you die.

Claims that are declined by the administrator can be taken to court where a probate court will certainly have the last say as to whether or not the case is legitimate.

Estate Planning Attorney Can Be Fun For Anyone

After the stock of the estate has been taken, the value of assets computed, and tax obligations and financial debt settled, the executor will after that look for permission from the court to distribute whatever is left of the estate to the recipients. Any kind of estate tax obligations that are pending will come due within nine months of the day of fatality.

Each private areas their possessions in the depend on and names a person besides their partner as the beneficiary. A-B trust funds have actually come to be much less prominent as the estate tax exemption functions well for the majority of estates. Grandparents might transfer properties to an entity, such as a 529 strategy, to sustain grandchildrens' education.

The Ultimate Guide To Estate Planning Attorney

Estate organizers can deal with the benefactor in order to minimize taxed earnings as an outcome of those contributions or create methods that take full advantage of the effect of those donations. This is an additional technique that can be made use of to limit fatality taxes. It includes a specific locking in the existing value, and hence tax obligation obligation, anonymous of their residential property, while associating the worth of future growth of that capital to an additional individual. This approach involves cold the worth of a property at its value on the day of transfer. As necessary, the amount of potential capital gain at death is also frozen, allowing the estate organizer to estimate their potential tax obligation upon death and better prepare for the settlement of earnings tax obligations.

If sufficient insurance proceeds are straight from the source readily available and the policies are appropriately structured, any type of earnings tax obligation on the regarded dispositions of assets following the death of a person can be paid without considering the sale of assets. Profits from life insurance policy that are obtained by web link the recipients upon the death of the insured are typically earnings tax-free.

Other charges connected with estate preparation include the prep work of a will, which can be as reduced as a couple of hundred bucks if you utilize among the ideal online will makers. There are certain records you'll require as part of the estate planning process - Estate Planning Attorney. Some of one of the most common ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is only for high-net-worth people. Estate preparing makes it easier for people to determine their desires prior to and after they die.

The 5-Minute Rule for Estate Planning Attorney

You ought to start planning for your estate as soon as you have any kind of measurable possession base. It's an ongoing procedure: as life advances, your estate plan must move to match your situations, in line with your brand-new objectives.

Estate preparation is often believed of as a device for the rich. Estate planning is likewise a wonderful means for you to lay out strategies for the treatment of your small youngsters and family pets and to detail your desires for your funeral and favorite charities.

Eligible candidates who pass the exam will be officially licensed in August. If you're eligible to rest for the examination from a previous application, you might file the brief application.

Report this page